Upgrading to a high-efficiency heat pump can significantly lower energy costs, especially if you’re replacing an older HVAC system or switching from gas or oil heating. Heat pumps work by transferring heat instead of generating it, making them far more energy-efficient than traditional heating and cooling systems.

The efficiency of a heat pump is measured by its SEER (Seasonal Energy Efficiency Ratio) for cooling and HSPF (Heating Seasonal Performance Factor) for heating. Older heat pumps may have a SEER rating of 10 to 14, while modern high-efficiency models often exceed SEER 20.

A higher SEER rating means the system requires less electricity to cool your home, helping to lower monthly energy bills. Similarly, upgrading from an older HSPF 7 or 8 unit to a HSPF 10+ model can result in significant winter heating savings.

Supplementing a gas furnace or oil boiler with a heat pump you can depend on for most of your heating during the fall and winter months can drastically reduce energy costs for Rockville and DMV-area homeowners, especially with rising fuel prices.

Many traditional gas furnaces operate at 78% to 90% efficiency, meaning 10% to 22% of the energy is lost during combustion. Heat pumps don’t waste fuel because they don’t use combustion to generate heat.

Modern air-source heat pumps can reduce electricity use for heating by approximately 50% compared to electric resistance heating systems like furnaces and baseboard heaters.

Click through the slides to learn more!

How Much Can I Save With a Heat Pump?

A study by the National Renewable Energy Laboratory (NREL) found that, on average, heat pumps can reduce home energy use by 31% to 47%, depending on the system's efficiency and whether building upgrades, such as improved insulation, are implemented.

Maximize Savings with Heat Pump Incentives

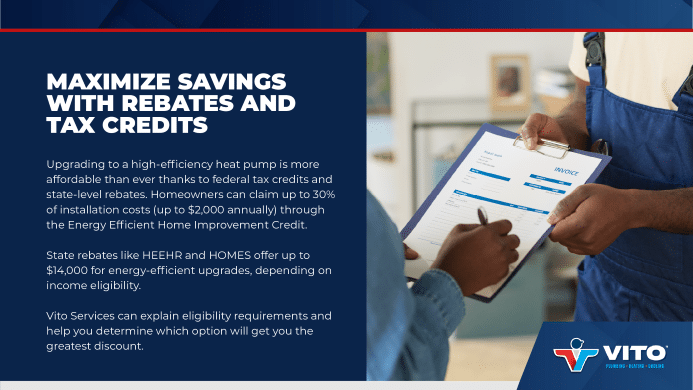

In addition to lowering your energy bills, installing a high-efficiency heat pump can qualify you for valuable tax credits and rebates. Federal, state, and local programs offer financial incentives to help offset the upfront cost, making it even more affordable to upgrade your home’s heating and cooling system.

Energy Efficient Home Improvement Credit (25C Tax Credit)

Homeowners can claim a tax credit of up to 30% of the installation cost for qualifying heat pumps, with a maximum credit of $2,000 annually. This credit is available through 2032.

High Efficiency Electric Home Rebate Program (HEEHR)

The HEEHRA program offers income-based rebates of up to $8,000 for heat pump installations that can be combined with the HOMES rebate. Households earning below 80% of the Area Median Income (AMI) can qualify for a rebate covering up to 100% of project costs, while moderate-income households (80%–150% AMI) can receive up to 50% of costs. Rebates are not retroactive, so homeowners must apply before installation to qualify.

Homeowner Managing Energy Savings (HOMES) Rebate Program

The HOMES rebate program provides performance-based rebates for whole-home energy efficiency improvements, including heat pump installations. When combined with HEEHRA, the total maximum rebate amount is $14,000.

The heat pump installation professionals at Vito Services can explain the government incentives available for residents of Maryland, Virginia and D.C.

Montgomery County Energy Efficiency Tax Credit

Montgomery County residents can claim a $250 property tax credit for energy-efficient upgrades, such as heat pump installations. This credit is available once per fiscal year (July 1 – June 30) and has a total annual cap of $100,000 countywide, so early application is advisable.

DC Sustainable Energy Utility (DCSEU) Rebates

The DCSEU offers rebates ranging from $250 to $5,000 for qualifying electric heat pumps, heat pump water heaters, and air conditioners. All equipment must be installed by a DC-licensed contractor to qualify.

Funding for the Virginia Home Energy Savings Program has been exhausted as of October 2024, with potential renewal anticipated in mid-2025.

Determining Income-Based Eligibility

Only households categorized as low-income, or those earning less than 80% of the Area Median Income (AMI) will qualify for a rebate of up to 100% of their project costs, with a maximum of $14,000.

Moderate-income households earning between 80% and 150% of AMI may qualify for a rebate covering up to 50% of their project costs, with a maximum of $14,000.

Households earning above 150% AMI are not eligible for the HEEHRA rebate.

You can use Freddie Mac’s tool to determine the median income for your area. In Rockville, your results may look like this:

- 50% Area Median Income: $76,450

- 80% Area Median Income: $122,320

- 100% Area Median Income: $152,900

- 120% Area Median Income: $183,480

- 140% Area Median Income: $214,060

The maximum HEEHRA and HOMES rebate of $14,000 is available to all eligible households. For example, a household in the 80% to 150% range can still get a $14,000 rebate if their qualifying upgrade costs $28,000 or more.

Take Advantage of These Heat Pump Installation Incentives While They Last

Property owners in Rockville and the greater DMV area who want to learn more about heat pumps, rebates and other efficiency-enhancing HVAC upgrades can call Vito Services at 301-251-0211 . Our experts can assess your home's insulation, explain your heat pump installation options, and help you maximize your discount.